–> Click here to see more hospitality news and insights.

HMRC has confirmed that the mandatory payrolling of benefits in kind (BIKs) will be delayed to April 2027, giving businesses more time to get to grips with the process. Previously planned for April 2026, the change will require businesses to report and process income tax and Class 1A national insurance

From the 2024-25 tax year, self-employed individuals with profits in excess of £6,725 no longer need to pay Class 2 national insurance contributions (NIC). Instead those taxpayers will receive a national insurance credit to secure their access to contributory benefits such as the state pension. Several of the professional bodies

Making Tax Digital for Income Tax (MTD IT) is fast approaching, with the mandation date for sole traders and landlords with qualifying income of £50,000 and above set firmly at 6.4.26. In addition to the annual tax return, those mandated to comply with the MTD IT requirements will need to

The Check Employment Status for Tax (CEST) tool allows contractors and other individuals providing services – or businesses engaging workers to perform services for them – to determine whether the work should be treated as employment or self-employment for tax purposes. The responsibility for determining the employment status will fall

With effect from 6.4.25 the preferential tax treatment enjoyed by UK resident individuals whose permanent home is outside the UK (‘non-doms’) has been withdrawn. Before this date, non-doms could benefit from the remittance basis of taxation for up to fifteen years, essentially exempting their offshore income and gains from UK

Small employers can usually recover 100% of most of the statutory payments they make to employees plus compensation from HMRC. If your business qualifies for small employers’ relief you can claim 103% of almost all statutory payments made to employees until 5.4.25. From 6.4.25 this was increased to 108.5% in

Tax-free childcare Many working families will now be arranging childcare for the school summer holidays and the start and end of the school day from September. The Government’s tax-free childcare scheme could provide up to £2,000 a year per child, or £4,000 if the child is disabled, towards the cost

The salaried members rules are an anti-avoidance measure designed to prevent limited liability partnerships (LLPs) from disguising remuneration paid to members as profit share instead of employment income. If the rules are triggered, the member’s earnings are subject to PAYE and national insurance as though they were an employee. A

Changes to the company size thresholds from April 2025 will also apply for the purposes of the off-payroll working (OPW) rules The primary aim of the changes to the company size thresholds was to simplify regulatory requirements and alleviate the administrative burden for smaller businesses. HMRC has now confirmed that

From August 2025 employed taxpayers will no longer be required to complete a self assessment tax return (SATR) to declare and pay the high-income child benefit charge (HICBC) The HICBC is a tax charge paid by the higher earning parent which claws back up to 100% of the child benefit

From April 2026 most benefits in kind (BIKs) will have to be processed through the payroll and included on monthly payslips, with a potential knock-on effect for student loan repayments The mandatory payrolling of BIKs will be implemented in phases, starting from April 2026. The earnings threshold above which student

HMRC has updated its guidance to clarify the treatment of subcontracted research and development (R&D) expenditure under the SME scheme When R&D work undertaken by a subcontractor is subsidised, tax relief is not available to the subcontractor under the SME R&D scheme. Following two recent taxpayer wins at the First-tier

HMRC has announced that it will close the online service for filing company accounts and corporation tax returns on 31 March 2026 Companies with an accounting period ending after 31 March 2025 will no longer be able to use HMRC’s free online service (unless they file before 1 April 2026)

In just over a year the first tranche of sole traders and landlords will be required by law to keep digital records to comply with the requirements of Making Tax Digital for Income Tax (MTD IT) From April 2026, taxpayers with qualifying trading and property income of £50,000 or more

The Government has announced plans to increase the threshold above which income from self-employment must be reported via self-assessment. Currently, if you earn over £1,000 from self-employment, or a so-called ‘side hustle’ such as babysitting or dog walking, you need to report this income to HMRC by filing a self

With changes to employer’s National Insurance and the Employment Allowance, now is the time for businesses to review the most tax efficient mix of salary and dividends for directors. From 6 April 2025 the secondary Class 1 National Insurance threshold reduces from £9,100 to £5,000. At the same time the

In April 2025, the British Institute of Innkeeping (BII), representing over 13,000 independent pub operators, issued a call to the UK government for meaningful financial support in tax relief. The plea comes as pubs grapple with the cumulative impact of recent tax changes, including increased employer National Insurance Contributions (NICs),

Recent data from the ONS indicates continued volatility in prices on energy updates, impacting operational costs for hospitality businesses: Gas Prices: The System Average Price (SAP) of gas increased by 3% to 4.173 pence per kilowatt hour (p/kWh) in the week to 19 January 2025, compared to the previous week.

In March 2025, the UK’s hospitality and leisure sector experienced a 2.8% year-on-year increase in consumer spending, maintaining the momentum from February’s 2.9% growth. This steady performance comes despite broader economic challenges and shifting consumer behaviours. Key Insights: Bars, Pubs & Clubs: After a 2.0% decline in February, this segment

The UK hospitality sector is confronting significant financial challenges due to recent tax reforms and wage increases. These changes are reshaping operational costs and staffing strategies across the industry. Key Financial Changes Impacting Hospitality: Employer National Insurance Contributions (NICs): Effective April 6, 2025, the employer NIC rate increased from 13.8%

With the arrival of warmer weather and a notable 5% increase in drinks sales during the first week of April 2025, UK pubs are experiencing a promising start to the spring season. This uptick, reported by CGA by NIQ, highlights the potential benefits of leveraging outdoor spaces to attract patrons

As of March 2025, UK inflation has eased to 2.6%, marking its lowest point since October 2024. However, this relief may be short-lived. Industry experts warn of an impending resurgence in food inflation, driven by recent tax changes and rising operational costs. Key Drivers of Upcoming Inflation Increased Operational Costs:

UK pubs are confronting significant challenges due to a tightening chicken supply chain and escalating costs. Popular menu items such as chicken wings, burgers, skewers, and Sunday roasts are under pressure as domestic producers struggle to meet demand, and avian flu impacts imports. Key Factors Contributing to the Chicken Crisis:

The first week of April 2025 brought a welcome uplift for UK pubs, with average drinks sales in managed venues rising by 5% compared to the same period in 2024. This increase, reported by CGA by NIQ’s Daily Drinks Tracker, follows a 2% sales growth in March, signalling potential momentum

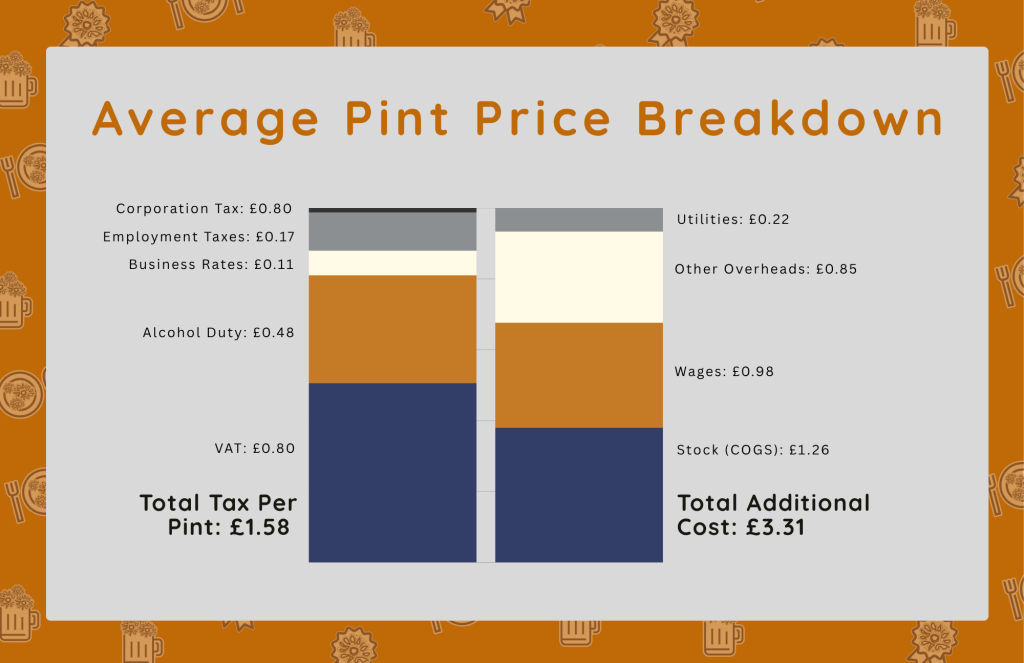

According to the BBPA, the average £4.80 pint is now pouring at a 9p loss. To keep the usual 12p profit, prices would need to rise to £5.01. We’ve been working closely with our hospitality clients, and the response isn’t one-size-fits-all. Some have raised prices by 50p to protect their

From 6 April 2025, UK hospitality businesses will face a significant increase in Employers’ National Insurance (NI) contributions. This means higher costs per employee, adding further strain on payroll, hiring decisions, and profitability. With just weeks to go, hospitality businesses need to act fast to protect their margins and sustain

A strong business plan is key to securing the right lease for your hospitality business. Whether it’s a restaurant, pub, or café, a business plan shows landlords you can manage operations, understand the market’s needs, and have stable finances. A well-written plan helps guide your business’s growth and shows landlords

Many more sole traders and landlords will be required to comply with making tax digital (MTD) for income tax when the qualifying income threshold is reduced from £30,000 to £20,000. The Budget confirmed that taxpayers with qualifying income of £50,000 or more will be required to join MTD in April

The sunset clause which was set to end the Enterprise Investment Scheme (EIS) and Venture Capital Trust (VCT) scheme on 5 April 2025 has been extended for a further ten years. The schemes, which offer tax relief for individuals investing in qualifying small and medium-sized companies including start-ups, will now

It is common for some employers to pay their workers earlier than usual in December, for example if the business will be closed during the festive period. While this may make sense for the business, being paid early can have an unwanted impact on an employee’s current and future entitlements

As announced in the Autumn Budget, the national minimum wage (NMW) and the national living wage (NLW) are set to increase from April 2025. The hourly rate will depend on the worker’s age and whether they are an apprentice. Age of worker Hourly rate from 1 April 2025 Hourly rate

The changes to capital gains tax (CGT) announced in the Autumn Budget are subject to anti-forestalling rules designed to prevent taxpayers from circumventing the new rates and rules. In the Autumn Budget the Chancellor announced an immediate increase to the main rates of capital gains tax (CGT). From 30.10.24, ‘Budget

HMRC has tightened up the process for claiming tax deductible employment expenses following a series of high-profile scandals. If you incur job-related expenses of up to £2,500 which are not fully reimbursed by your employer you may be able to claim tax relief. For expenses to be eligible for relief

When was the last time you checked your national insurance (NI) record for unexpected gaps or viewed your state pension forecast? Missing qualifying years in your NI record, or ‘gaps’, can reduce the amount of contributory benefits you are entitled to. This includes maternity pay, employment allowance, the state pension

At the Autumn Budget the Chancellor announced plans to remove the exemption which allows unused pension funds to be inherited tax free. Currently, if a pension holder dies before the age of 75 their beneficiaries can generally inherit the remaining funds tax-free, whether as a lump sum or as income.

The headline news from the Spring Budget was further cuts to national insurance contributions (NIC) of 2% each for self-employed taxpayers and employees. The main rate of primary Class 1 NIC paid by employees on earnings between £12,570 and £50,270 per year will be cut from 10% to 8% from

The earnings threshold above which businesses must register for and start charging VAT has been increased. Effective from 1 April 2024, the taxable turnover above which a business is required to register and account for VAT will be increased from £85,000 to £90,000. This is the first change to the

Owners of furnished holiday lets will lose their entitlement to favourable income tax, capital gains tax and capital allowances as the FHL scheme is abolished. If you own a property that you rent out on a short term basis for holiday rentals, subject to certain qualifying conditions, you may benefit

The remittance basis tax relief offered to non-UK domiciled individuals (non-doms) will be removed and replaced with a simpler residence-based regime from 6 April 2025. The new system will ensure that all UK residents who stay in the UK for over four years will pay the same tax on their

Two new savings products have been announced, aimed at supporting growth of UK companies and encouraging a culture of saving. Individuals can currently deposit up to £20,000 each year into an individual savings account (ISA). This is a sensible move as any interest earned is tax free. The annual limit

The threshold for earnings above which you have to pay back some or all of your child benefit will be increased from 6 April 2024 with a full overhaul of the regime promised in April 2026. If you or your partner receive child benefit and your adjusted net income is

Multiple dwellings relief (MDR) can significantly reduce the stamp duty land tax (SDLT) payable on the purchase of two or more properties in one transaction. When a taxpayer purchases a property that consists of more than one dwelling they may claim MDR to reduce the amount of SDLT payable on

The higher rate of capital gains tax (CGT) for residential property disposals will be cut from 28% to 24% from 6 April 2024. The lower rate will remain at 18% for any gains that fall within an individual’s unused basic rate band. The annual exempt amount will be lowered as

New guidance from HMRC confirms that profits used to assess student loan repayments and entitlement to student finance will include transitional profits from basis period reform. Student loan repayments for self-employed taxpayers are based on the profits reported in each tax year. For the tax years 2023-24 to 2027-28 this

HMRC has reminded investors in cryptoassets that they should declare any income or gains above the tax-free allowance on a tax return. If you hold cryptoassets such as Bitcoin you need to pay tax on any income or gains you have made. Most individuals investing in cryptoassets will be subject

The reporting and paying of income tax and Class 1A national insurance contributions on benefits in kind is to be made mandatory via payroll software from April 2026. Most employers who have not entered into a PAYE settlement agreement currently report benefits in kind (BIKs) provided to employees on the

HMRC has confirmed the mandation dates for making tax digital for income tax self assessment (MTD SA) as announced in the Autumn Statement 2023. From April 2026, taxpayers subject to income tax on their trade, profession, property income or business and who have income above £50,000 will be required to

There are currently three forms of compensation being awarded to subpostmasters following the Horizon scandal and each will have different tax implications. Money paid to subpostmasters under the Group Litigation Order (GLO) and overturned convictions schemes is not taxable. These payments are awarded in recognition of the unfair and unequal

HMRC has updated the recommended reimbursement rates for employees reclaiming business travel in company vehicles. If you pay for the fuel in your company car your employer can reimburse you for the cost of business journeys in that car at the following mileage rates tax free from 1 March 2024: