Cash is King: Understanding the Vitality of Cash Flow

Have you ever pondered why, despite your business showing a healthy profit on paper, you find yourself grappling with cash flow issues? It’s a common dilemma that many entrepreneurs and business owners face. You’re not alone if you’ve ever heard the saying, “Turnover is vanity, profit is sanity, but cash flow is reality.” In this […]

Unlocking Success: The Ongoing Relevance of Business Planning

Business planning, a term often associated with the early stages of a venture. Entrepreneurs meticulously craft their business plans to secure funding, impress potential investors, and map out their initial journey. But what happens next? Why is business planning more than just a one-time activity that collects dust in the bottom drawer of your desk? […]

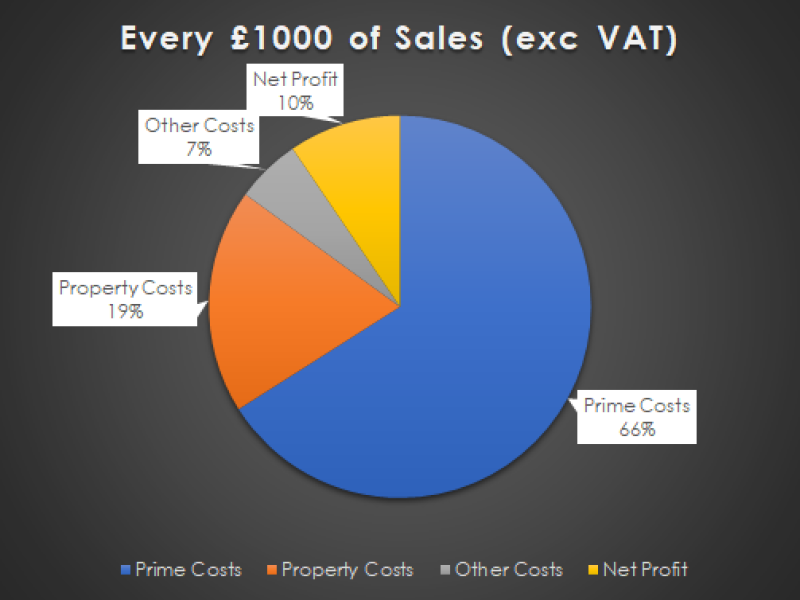

It’s Prime Time You Considered Your Venues’ Prime Cost

Prime costs are an important key performance indicator for your restaurant, which is often overlooked. Prime costs are one of the most important and revealing numbers on any restaurant’s P&L. They can give you a much better understanding of your cost structure, profit potential and how well your restaurant is being managed and is one […]

Key Performance Indicators (KPIs) for Measuring Hotel Financial Performance

In the dynamic and competitive hotel industry, measuring financial performance is essential for business success. Key Performance Indicators (KPIs) serve as valuable metrics to evaluate a hotel’s financial health and identify areas for improvement. This blog explores the key KPIs that hoteliers should monitor to gain insights into their financial performance and make informed decisions […]

The Importance of Bookkeeping for Restaurants: Keeping Your Finances in Order

Running a successful restaurant involves more than just serving delicious food and providing excellent service. Behind the scenes, effective financial management plays a critical role in ensuring your restaurant’s success and long-term sustainability. One key aspect of this financial management is bookkeeping. In this blog, we will delve into the importance of bookkeeping for restaurants […]

Understanding the Unique Accounting Needs of Hotels: Insights from Carroll Accountants

As a hotelier, you know that running a successful hotel requires expertise in various areas, including accounting. Managing the finances of a hotel comes with its own set of challenges and complexities that demand specialised knowledge. At Carroll Accountants, we understand the unique accounting needs of hotels and can provide invaluable insights to help you […]

The Advantages of Engaging Licensed Trade Accountants in the UK: Unlocking Your Business Potential

Running a licensed trade business in the UK comes with unique challenges and intricacies. From managing complex financial regulations to maximising profitability, the expertise of licensed trade accountants can be invaluable. At Carroll Accountants, we specialise in providing comprehensive accounting services tailored specifically to the licensed trade industry. In this article, we will explore the […]

Maximising Profitability: 5 Strategies for Controlling Labour Costs in Your Restaurant, Pub or Bar

As any entrepreneur in the food and beverage industry knows, optimising profitability is of paramount importance. One of the key aspects that demands attention is controlling labour costs. The remuneration offered to the staff, the associated benefits and taxes all contribute to the overheads and can erode profits if not managed properly. In this article, […]

The Indispensable Role of Specialised Accountants in the Competitive World of Hospitality Businesses: Unlocking Financial Success with Carroll Accountants

In the fiercely competitive landscape of the hospitality industry, the need for proficient accounting professionals cannot be overstated. When it comes to managing the financial intricacies of establishments such as pubs, bars, restaurants, and cafes, a team of trained and specialised accountants is crucial. This article explores the profound significance of entrusting your hospitality business’s […]

Break-Even – What’s the Point?

This is a great tool to calculate, well what it says, the “break-even point”. This point is when the sales cover your total annual costs and no profit or loss is made. You may ask yourself, why do I want to just break-even? What’s the point of that? You are right of course, but it’s […]